Tax credit cut to hit early years workers hard

Catherine Gaunt and Katy Morton

Sunday, November 1, 2015

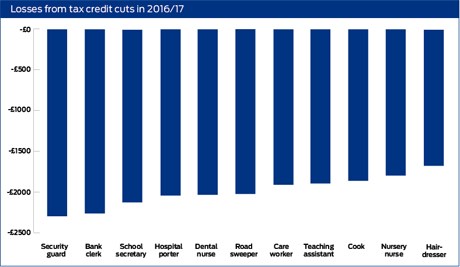

As the Government faced a revolt in the House of Lords with peers voting to delay cuts to tax credits, a new analysis shows nursery nurses would be among those in jobs hardest hit from next April.

Research by The Children’s Society and Child Poverty Action Group (CPAG) has found that nursery nurses are set to lose £1,788 a year under the current proposals.

Teaching assistants and care workers would also be hard hit by the changes (see table).

After two motions were passed by peers last week, Chancellor George Osborne has said that he intends to press ahead with changes to tax credits but is now committed to ‘lessening’ the impact on families.

The new proposals will be revealed in the Autumn Statement at the end of November.

Meanwhile, during Prime Minister’s Questions, David Cameron refused to answer a question asked six times from Labour leader Jeremy Corbyn about whether families would be worse off under the revised tax credit plans.

The CPAG calculations are for sole earners working full-time, either as a single parent or a sole earner in a couple family.

They are based on data from the Office of National Statistics and House of Commons Library on typical gross earnings.

A spokesperson for the CPAG said, ‘We hope ministers take a deep breath and admit that these cuts will pull the rug from under the feet of working families. Ministers should now bring forward new measures to help working families – investing in tax credits, not cutting them.

‘Nobody who supports hard-working families can think it’s right to suck £1,788 from the tax credits of a nursery nurse’s annual income. These are grafting parents, often working long hours and trying to provide for their children. And if they are struggling now to pay for food, utilities, fares and children’s clothing, these kind of losses will make them fear for the future.’

The Children’s Society echoed CPAG’s call for the Government to make sure work always pays for families.

Director of policy and research at The Children’s Society Sam Royston said, ‘We urge the Government to rethink its damaging approach to tax credit changes before children are made to pay a heavy price.

‘It is now clear that children would be the biggest losers as a result of these changes, with about 4.5 million affected.

‘If the Government is serious about being the champion of hard-working families, as it claims to be, it must make sure that work always pays – and not push children in working families into poverty.’

Early years organisations and children’s charities have welcomed the Lords’ decision to delay the changes, which would see the income threshold for those claiming Child Tax Credit cut from £16,105 to £12,125 a year and the threshold for Working Tax Credit from £6,420 to £3,850, from April 2016.

Tricia Pritchard, senior professional officer (early years and childcare) from Voice, the union for education professionals, said, ‘Nursery staff are already among the lowest paid workers and therefore any worsening of their pay and conditions would inevitably impact negatively on provision as a whole.

‘Our fear is that if the proposed changes to tax credits were to result in loss to income in the region of £1,788 a year, many practitioners would be forced to leave the profession, hastening the decline in recruitment and retention.

‘We could actually lose nursery places or, even worse, see nurseries close.

‘Our members work long hours and are already struggling to make ends meet. Family life for low-income families is already tough. These proposals add to their challenges by potentially placing their jobs in jeopardy and reducing provision for those who need it most.’

Neil Leitch, chief executive of the Pre-School Learning Alliance said, ‘For many years now, the sector has survived on the hard work and commitment of dedicated, passionate practitioners, most of whom work long hours for little pay simply because they love what they do. For these same professionals to suffer even further financially as a result of this policy is unacceptable. As such, we welcome recent pressure on the Government to rethink these plans, and hope that it will do so at the earliest opportunity.’

Peers voted 307 to 277 in favour of a motion put forward by Baroness Meacher to put on hold Government plans to cut tax credits next year because the Government had not responded to an analysis by the Institute of Fiscal Studies that showed that three million families would lose £1,000 a year.

They also voted in favour of a motion tabled by the former Labour social security minister Lady Hollis insisting the Government provide all low-income families and individuals currently receiving tax credits with three years’ compensation.