EXCLUSIVE: Big divide in nursery losses

Monday, November 26, 2018

Nursery World’s exclusive investigation into the first year of the 30 hours reveals stark variations in nursery closures across the country.

- Net closure of nurseries varies by local authority

- Highlights trend of consolidation in the sector

Nursery World’s exclusive investigation into the first year of the 30 hours reveals stark variations in nursery closures across the country.

For the most part there does not appear to have been much impact on the number of childcare places, suggesting that smaller nurseries are closing and biggers ones are opening.

Our analysis reveals that while some local authorities experienced a net loss of private, voluntary and independent (PVI) settings between 2017 and 2018, in other areas either more opened or the same number opened that closed.

In two local authorities, Essex and Kent, many more nurseries opened than closed during the 12-month period (see charts).

While 24 nurseries closed in Essex – one of the largest counties in England – 47 opened. In Kent, just two nurseries closed and 74 opened.

The findings are taken from responses to a Freedom of Information (FOI) request submitted to local authorities by Nursery World. Figures are based on the difference in the number of nurseries that opened and closed between September 2017 and September 2018.

Closures

Of the 106 councils that responded, 52 had more nurseries close than open. In total, there were 157 net closures.

Some of those with the biggest net closures were rural local authorities – Cumbria with 12, Wiltshire with eight, and Lancashire with six – along with local authorities with high pockets of deprivation, including Manchester losing six, Walsall five and Liverpool City five.

Both Lancashire and Liverpool’s funding rates for the 15 and 30 hours fell between 2017-18 and 2018-19.

Ceeda’s About Early Years annual report, published last month, found that the number of childcare places per head has fallen in the most-deprived local authority areas, but increased in the least-deprived areas.

Cumbria County Council said reasons for closures included falling numbers of children requiring provision and the challenge for voluntary organisations to recruit committee members.

A spokesperson for the council said, ‘Cumbria is England’s second-largest county geographically. It is a diverse county with dense urban and coastal areas, as well as sparsely populated, rural areas. There are 180 PVI providers (excluding childminders) which provide childcare throughout Cumbria.’

A Wiltshire Council spokesperson said, 'Where it’s appropriate we always support a provider to continue with their nursery provision. We have had some closures but also had new nurseries open since September 2018 and more are due to open across the county. Once they are all opened we will have the same number of nurseries as before offering parents and carers a range of choices.' *

Manchester City Council said ‘the national offer of free childcare places is having a negative impact on some providers’. Councillor Garry Bridges, executive member for children’s services, said the council monitored the need for early years places. ‘At the moment there are still more than enough childcare places to go round, but we are very aware of the challenges facing the sector.’

County councillor Susie Charles, Lancashire’s cabinet member for children, young people and schools, said, ‘It is important to put these figures into context and as Lancashire is one of the largest local authorities in the country we are always likely to appear high in terms of numbers [closures].’

In Rutland, the smallest county in England, there was a loss of four nurseries. Brighton & Hove, Wakefield, Blackburn and Lambeth also lost four nurseries.

Funding rates for three- and four-year-old places also fell in Rutland and Lambeth this year.

The figures show that for the majority of local authorities that reported a net loss of nurseries, the closures amounted to just one or two settings.

Openings

Of the 106 local authorities that responded to the FOI, 54 had no net losses, with more or the same number of nurseries opening as closing.

Local authorities that saw net increases of nurseries included Nottingham, Herefordshire, the London borough of Greenwich and Warwickshire.

Previous year

Of the local authorities where more nurseries closed than opened, the majority did not have any net losses in the prior year, according to Ofsted figures for March 2016 and August 2017.

However, Somerset, Torbay and Blackpool experienced marginally higher net losses of nurseries between 2016-17, compared to 2017-18.

Childcare places

We asked local authorities to provide the number of childcare places available for children aged from birth to five at PVI settings as of September 2018 and the prior year.

Of the 106 councils that responded, 64 provided figures for childcare places for both years. The figures suggest that in local authorities with net closures of nurseries in 2017-18, the impact on childcare places was less than could be expected from the net loss in providers.

Cumbria, for example, which had a net loss of 12 nurseries and 14 childminders, lost 245 childcare places between 2017 and 2018.

Walsall, which had a net loss of five nurseries and 14 childminders, lost 266 places.

In Liverpool City, which had a net loss of five nurseries and five childminders, childcare places actually increased by 522.

This echoes comments made by Courteney Donaldson, director of Christie & Co, at the recent Nursery World Business Summit, that it is 30- to 40-place settings that are closing. At the same time, she said there has been an increase in planning permission for 100- to 200-place purpose-built nurseries.

Redwoods Dowling Kerr, which reported record sales for the month of October, also said the 30 hours had affected nurseries with smaller capacities and those in more remote areas with a higher than average level of funded-only children.

Head of childcare Jenna Caldwell told Nursery World, ‘The current childcare market is still incredibly buoyant with a multitude of investors seeking acquisition opportunities within the UK.

‘Given the current level of deals we have in the pipelines and the conversations we are having with buyers and investors, we have no doubt that merger and acquisition activity will continue to be strong for the foreseeable future.’

The larger nursery groups have also continued to expand and acquire settings.

This year alone, Kids Planet has opened ten nurseries. Bright Horizons has meanwhile bought the Yellow Dot group of 12 nurseries and Zoom’s five.

Busy Bees has increased its nurseries from 342 last autumn to 352 as of this month. The group said the 30 hours has had no impact on the nurseries. While it has closed settings, that has been because of leases on the buildings expiring.

Steve Eccleston, development director at Busy Bees, said, ‘In the UK, Busy Bees has 352 nurseries. This includes two new nurseries that have opened and six which have closed in 2018. These nurseries were closed after their leaseholds expired and we took the commercial decision not to renew them.’

Comments

The Pre-school Learning Alliance said the replacement of small nurseries with larger settings was a concerning trend and risks diminishing parental choice. The National Day Nurseries Association said it was no surprise that the areas most affected have the lowest funding rates.

Dr Jo Verrill, managing director of independent early years research group Ceeda, said, ‘The sector is undoubtedly experiencing a period of consolidation. To understand the impact of closures on childcare supply, it is necessary to look at places in relation to child populations at local level – the Government’s focus on net changes at national level is both misleading and concerning.’

A DfE spokesperson said, 'The number of childcare places has remained broadly stable since August 2012 and with the introduction of 30 hours, we have had no reported issues about a lack of available places.

'We are investing record amounts – around £6 billion a year on childcare support by 2020. This includes around £3.5 billion which we plan to spend this year alone on all our free early education offers – to make sure as many children as possible have access to high-quality care.'

CASE STUDY: JOYLAND

This 32-place nursery, run from owner Lynn Hoare’s home in Brighton since 1986, is to close at Christmas. The Outstanding setting is term-time-only and cares for two- to four-year-olds. Most receive 30 hours childcare.

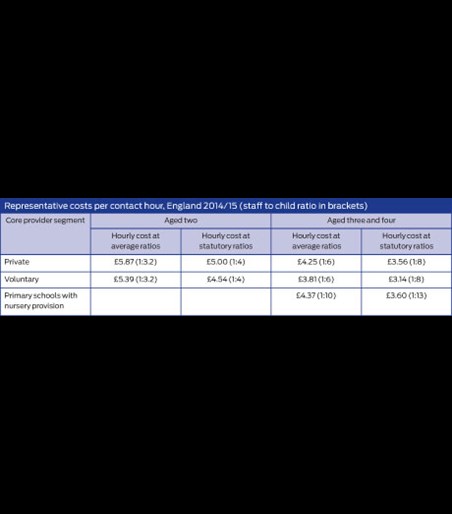

Ms Hoare said she was closing because the 30 hours has exacerbated underfunding. The setting receives £4 per hour per child, but the cost of a place is more than £6. ‘With the 15 hours, we could just about manage. Many parents wanted more hours so we could recoup our losses that way. No-one wants extra hours on top of the 30. We hadn’t made a profit for three years, but now we find ourselves running at a loss. We don’t charge for meals as parents bring in packed lunches for their children.

‘Sadly, I can’t continue losing money. My husband and I are living off our pensions. We are having to borrow the money to pay redundancy to staff.’

Ms Hoare said that despite funding issues, Brighton & Hove council has always been helpful and supportive.

She added, ‘Fortunately most parents have found an alternative nursery place for their child for next year.’

*Wiltshire Council's comment was added to the online version of this story as it was received after the magazine went to press.