Understanding staffing challenges – and finding solutions

Paul Langston, associate partner, CACI Location Intelligence

Wednesday, August 17, 2022

New data compiled by specialist research company CACI provides insights into the demographics of nursery staff and suggests strategies when it comes to boosting recruitment and retention in the sector.

We have all witnessed the recruitment and staffing crisis in the nursery sector, and it was a recurring issue raised at the Nursery World Business Summit earlier this year. Many of CACI’s clients are saying recruitment is an increasing challenge that is hampering business. In parallel sectors our clients are facing similar challenges, and some are closing sites that have faced ongoing recruitment issues.

As a result, businesses are doing everything they can to be more tempting. Examples include interest-free loans, support with housing and travel costs, and more flexible rotas. While these schemes are commendable, they play a part in a negative spiral of rising costs, in a context of global product supply issues, and cannot be seriously considered as long-term solutions.

There is no miracle cure, but solutions are required. To do this, we need to have a comprehensive understanding of the situation and identify who is currently working in the industry and who needs to be enticed in. Only then will we be able to implement relevant benefits that actually work.

To understand the staffing challenges CACI have used the Acorn demographic segmentation tools, that we typically use for analysing nursery customers, to assess the demographic characteristics of nursery staff.

Typically, private nurseries target parents in the affluent groups highlighted in red in Figure 1, at the top end of the Acorn income scale.

Figure 1 – Acorn Groups and Typical Target Parents

To understand the wants and needs of your staff Acorn profiled more than 10,000 staff members across over 400 nurseries, belonging to multiple nursery groups, nationally.

Figure 2 overlays the Acorn Groups most over-represented among nursery staff. The gold shaded ‘primary’ groups are critical for staffing. These three, relatively young, low-income groups make up almost 1/3 of all staff, and have very different demographics from the typical target parents. As such they are likely to have very different lifestyles and, more importantly for the staffing challenge, may not live in the same neighbourhoods as where successful nurseries are located.

A more mixed set of demographics make up a further 26 per cent of staff. We’ve defined these as the 'secondary' groups, as they are slightly less represented among nursery staff. These range from relatively high earning Career Climbers and Successful Suburbs to the lowest income group, Difficult Circumstances.

Three of these four secondary groups (marked with a green tick in Figure 2) overlap with the key parent Acorn groups. Areas with high volumes of these three may represent a possible profitability sweet-spot for nursery locations, as they have high potential for both valuable parents and sufficient target staff.

In contrast areas dominated by three of the most affluent, and highly targeted, Acorn Groups – Lavish Lifestyles, Executive Wealth and City Sophisticates have extremely low levels of staff representation. These three, marked with a blue cross in Figure 2, potentially represent areas of high risk for nursery operators. Whilst these locations should have no trouble with high value occupancy, they face staff shortages and rising staff and recruitment costs. In turn these pressures put risks on nursery profitability, safety and brand reputation.

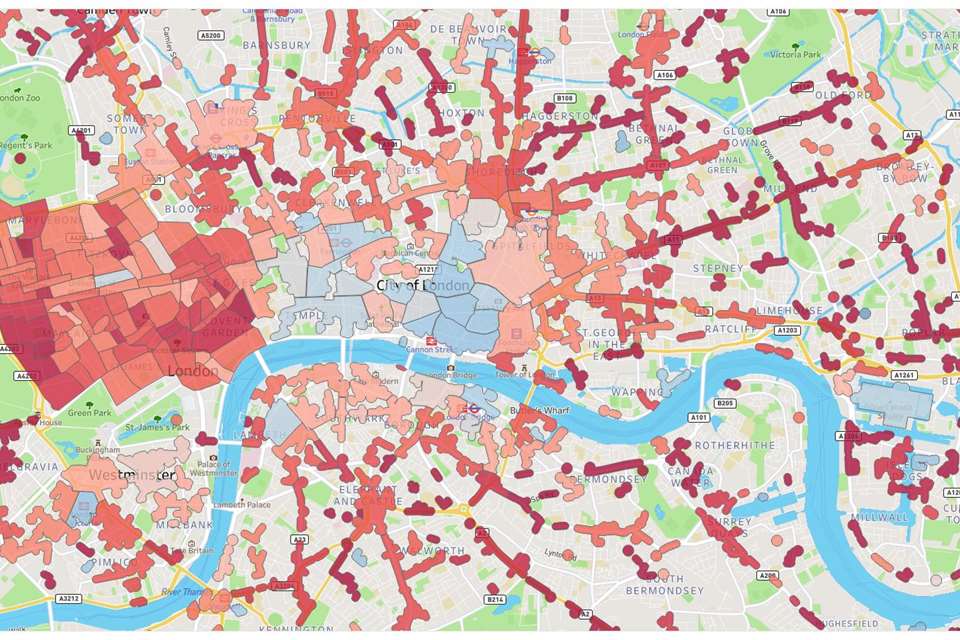

Figure 3 shows that many of the high risk and high opportunity areas are often found in fairly close proximity. In such areas careful recruitment targeting and offering support with transport costs and flexible hours could help entice staff from nearby locations.

Figure 3 – High Risk and High Opportunity Postcode Areas

With more than 450,000 people having left the wider UK workforce since 2019 the sector is in a fight to retain staff that are being enticed by other sectors, that are facing similar staff shortage and recruit from similar demographic groups. Call centre professionals, care givers and catering workers share similar Acorn characteristics, and the nursery sector needs to monitor rising salaries and relative benefits in these competing sectors to avoid losing staff who may think the grass is greener there. Similarly, nurseries should consider targeting these sectors and clearly selling the benefits of their roles to attract new recruits. Another possible rich seam could be enticing the large number of over 50s who left the national workforce during the pandemic into nursery roles as an attractive second career.

And remember, the cost of living crisis is likely to have a disproportionate impact on nursery staff. CACI’s analysis reveals that four of the seven primary and secondary staffing groups will see significant falls in their disposable incomes. This will increase the stresses faced by staff, and may drive wage inflation as nurseries compete to keep valuable staff who face key job decisions as they need to boost their incomes.

In summary, staffing is now such a key issue that it needs to be factored into decisions around where business should be operating and acquiring nurseries – as there are stark contrasts between the lifestyles of parents and staff in many settings, which could impact site viability.

Additionally, to ensure your nurseries retain and recruit the staff you need to operate safely and profitably you need to:

- Understand your staff and their needs

- Know where to target to recruit effectively

- Understand the extra pressures facing your staff as they experience a real-terms fall in their incomes from the rising cost of living.

For a more detailed version of this report and analysis please contact Olivia Johnston at ojohnston2@caci.co.uk.