Universal Credit: Part 2 - Credit where it’s due

David Finch, senior economic analyst at the Resolution Foundation

Monday, February 19, 2018

In the second part of this series, David Finch explains how Universal Credit differs from the tax credits system it is replacing, and how families may be affected

An ever greater number of families are beginning to interact with Universal Credit (UC) as its roll-out across the UK continues. In this article exploring the new scheme, I’ll consider the scale of change coming the way of up to seven million families as the current tax credits system is gradually replaced.

The greatest changes will be experienced by working families – both in how they make claims and how much financial support they will receive.

Unlike the tax credits system, which requires one large form-filling exercise a year, UC entitlement will be assessed every month. It takes into account changes in a number of family characteristics, such as how many children they have, any rent/mortgage payments paid, paid out childcare costs and, importantly, how much income they have.

For most, that income will be employee earnings. Whereas the tax credits system requires a household to report their earnings in the previous financial year, in UC a monthly feed of earnings information (submitted to HMRC by employers for tax purposes) will be used to assess incomings in the previous month.

This will help eliminate the under- and over-payments often seen in the tax credits system. However, it also means families will no longer be able to earn a little more (up to £2,500) than in the previous year without their entitlement being affected.

The big unknown will be how families respond to a shift from a stable monthly income provided by tax credits to a payment that varies from month to month depending on their recent earnings. It should help smooth incomes, with periods of low earnings offset by higher benefit awards. However, a late payday or pay cheques that don’t come through on a monthly basis could leave a family with no entitlement at all in a particular month.

The amount of financial support that UC offers differs too.

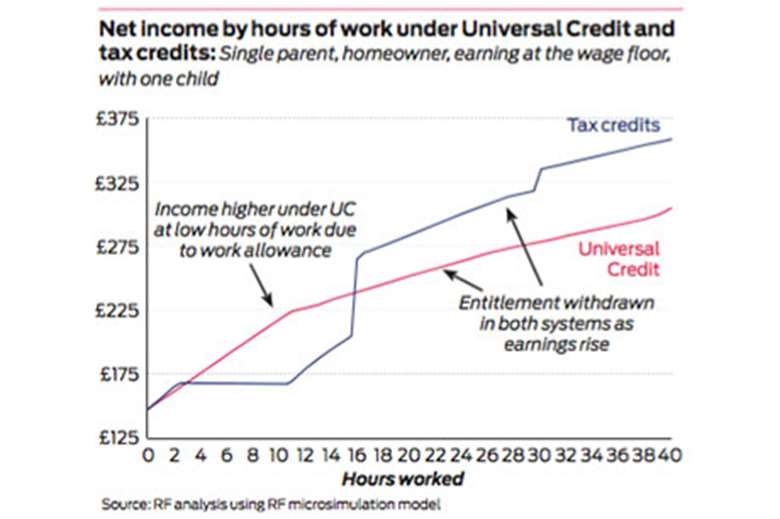

Working Tax Credit entitlement begins when a set number of hours have been worked (16 hours for single parents, 24 hours for a couple). This provides a large boost to income at that point, with support then gradually reduced as a family’s earnings increase. Many families are also entitled to Housing Benefit. This support with rental costs is also withdrawn as income rises, at an additional rate to tax credits support.

Under UC these benefits are claimed at the same time, combined in the same benefit, and reduced at a single rate as earnings rise. This support is only withdrawn once a certain monthly earnings limit, called a work allowance, is reached (£198 a month for renters, £409 a month for non-renters from April 2018). This makes Universal Credit more generous at very low levels of earnings.

The chart above sets out the key differences in the entitlement offered by the two schemes as a single parent increases their hours of work. In this example, under UC they are better off when working fewer than 16 hours, but worse off when working beyond that point.

However, UC is not that simple. Things get more complicated when we add in support with childcare costs and Council Tax Reduction schemes. There are also important differences in the measure of earnings used by both systems.

UC calculates entitlement based on net earnings – after income tax and National Insurance – rather than gross pay. This means a UC recipient will have the impact of changes to income tax (or NI) cushioned. For example, a £100 tax cut would provide an income boost of only £37 a week to a UC family. Equally, they would experience less of any tax rise.

Taking all of these changes together we would expect a mix of gainers and losers when comparing the two systems. However, the cuts to UC support for working families announced in 2015 mean that it will, overall, be less generous than the system it replaces for working families.

We expect more families with children to lose (1.8 million) than gain (1.3 million), and those losses will be greater on average (£55 per week) than the average gains (£47 per week). Overall, single parents can expect to see the biggest losses, with 700,000 losing an average of £57 per week, compared with 400,000 gaining £31 per week.

It is worth remembering that, for now at least, people move onto UC when their circumstances change so they should not find themselves losing entitlement overnight. Instead the support they receive may be less generous than what they would have received under tax credits.

By summer 2019, it is expected that existing cases will start moving across to UC even though they haven’t seen their circumstances change. This will include transitional protection to avoid families facing income falls. This lasts until their circumstances change, or their UC award increases beyond the previous tax credits one.

The final thing to bear in mind is that the switch to UC comes at a time of wider cuts to support for working-age families, including limiting support to families with more than two children and the ongoing four-year cash freeze to benefit rates.

UC adds further losses for working families but we are yet to see whether all of these reductions in support will come to pass, given wider pressure on living standards from weak wage growth and the political uncertainty from a minority government.

David Finch is a senior economic analyst at the Resolution Foundation