Autumn Budget 2018: the key points for early years

Tuesday, October 30, 2018

Delivering his Autumn Budget 2018 yesterday, the Chancellor announced more money for Universal Credit, children’s social care and the NHS, but nothing for the early years sector.

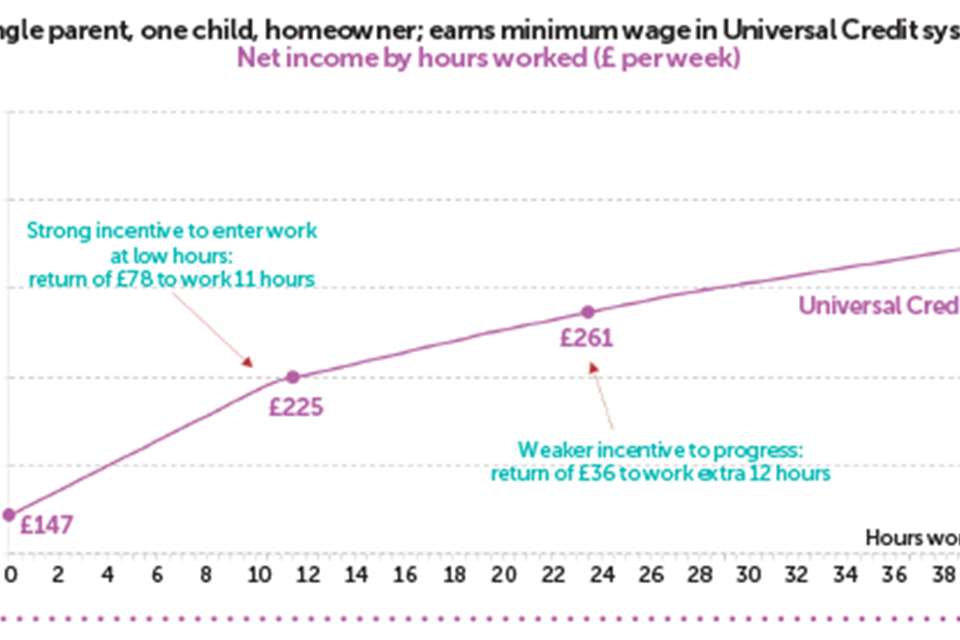

Speaking in the House of Commons he said, ‘Universal Credit is here to stay, and we are putting in the funding to make it a success. Because we believe that work should always pay.

‘The switch to Universal Credit is a long overdue and necessary reform.’

However, he said he recognised concerns about the implementation of the programme and about the rates and allowances, announcing an increase to work allowances – the amount people can earn before they start to lose money, and more funding for the roll-out of the system.

The Chancellor also announced increases to the national living wage and the rate at which people start paying income tax.

For schools, he revealed a £400 million one-off fund to pay for ‘extras’, money which unions have called ‘a drop in the ocean’.

The following package of measures was announced:

Welfare

- An increase to work allowances (the amount someone can earn before they start losing money) on Universal Credit to be increased by £1.7 billion.

- 2.4 million working families and people with disabilities are set to benefit by £630 a year.

- An extra £1 billion over five years to aid the transition to Universal Credit.

Education and health/social care

- A one-off £400 million bonus for schools to ‘buy the little extras they need’. Primary schools will receive an average of £10,000 each and secondaries £50,000 each.

- An extra £2 billion for mental health services – including children and young people’s crisis teams in every part of the country and a 24-hour mental health hotline.

- A total of £650 million for social care next year. As part of this successful children’s social care programmes will be expanded to a further 20 councils with high or rising numbers of children in care.

Tax and wages

- The personal allowance threshold, the rate at which people start paying tax, is to rise from £11,850 to £12,500 in April – a year earlier than planned. This means a basic rate tax payer will pay £1,205 less tax in 2019-20 than in 2010-11.

- The higher rate income tax threshold to rise from £46,350 to £50,000 in April.

- National living wage to increase from £7.83 to £8.21 an hour from April 2019.

Business

- Small employers will pay half of the contribution they currently make for apprenticeship training – down from 10 per cent to 5 per cent.

- To help retailers struggling with the high fixed costs of business rates, business rates will be cut by a third over two years for shops with a rateable value of £51,000 or less, but there are no similar measures for nurseries.

- From April, large businesses will be able to invest up to 25 per cent of their apprenticeship levy to support apprentices in their supply chain.

- New 100 per cent mandatory business rates relief for all public lavatories.

For more information on the packages of support announced in the Budget 2018 click here