Owners reeling at huge increases to business rates

Monday, October 17, 2016

Nurseries across the country have reacted with shock and anger to huge rises in business rates due to come into effect next April.

Nurseries across the country have reacted with shock and anger to huge rises in business rates due to come into effect next April.

The recent publication of new rateable values, which are used to determine business rates, shows that there will be dramatic increases for businesses in many parts of the country.

The Valuation Office Agency is supposed to revalue non-domestic properties in England and Wales every five years, and the large rises are partly due to the Government’s controversial decision to put this on hold two years ago.

Nurseries are bracing themselves for hikes – some could see their business rates double.

The Government is putting up the rates, which are collected by local authorities, for the first time since 2010.

The new rateable values are based on the rental value of properties on 1 April 2015, which has been used to calculate business rate bills from April 2017.

Local authorities have flexibility to offer discounts to businesses, and last year the then childcare minister Sam Gyimah asked the Department for Communities and Local Government to tell LAs to consider offering business rate relief to nurseries. For councils that did this, the Government would pay 50 per cent of the costs.

However, according to the National Day Nurseries Association, no local authority has acted on this advice.

Nurseries have told Nursery World that the Government should make this mandatory.

Northfield Under 5s in Rotherham is one nursery that will see its business rates double. It had only just had its rates reassessed after challenging them in 2013 when the nursery expanded, an appeal that took two-and-a-half years.

The rateable value was downgraded from £12,500 to £10,000, but the latest valuation has more than doubled it to £20,250 – a jump from £60/m2 to £120/m2. The increase means the nursery has been taken over the threshold for small business rate relief, the discount available for businesses that occupy one property and which have a rateable value below £12,000.

Owner John Armstrong told Nursery World, ‘It’s a major shock, the latest in a tsunami of legislation that is affecting small businesses.’

Nurseries are also unable to appeal until April 2017 when the new rates come into force. Changes to the appeals process mean Mr Armstrong has been warned that a new appeal could take several years.

The owner believes that nurseries should be zero-rated.

He added, ‘The Government has recommended that local authorities make nurseries exempt, but my understanding is that no local authority has taken up that option. I think nurseries should be a special case. I had thought the Conservative Party was the party for small businesses and entrepreneurs. This is the latest punitive [measure] – the National Living Wage, auto-enrolment pensions; early education funding is completely inadequate, and now business rates. You begin to wonder if they support entrepreneurs and small businesses like myself.

‘It’s going to be a huge problem – a lot of nurseries are teetering on the brink as it is.’

Mr Armstrong anticipates that the majority of the nursery’s 24 three- and four-year-olds will be eligible for the 30 hours free offer, but he is concerned about funding rates. He added, ‘I appeal to the Government to simplify the appeals process. If you have to wait three or four years, you could be sunk by then.’

SQUEEZED TIGHTER

Jennie Johnson, chief executive of Kids Allowed, said she had been advised to appeal.

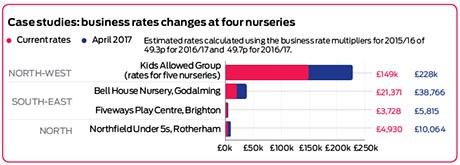

‘The rateable value has changed quite significantly,’ she said. The nursery group currently pays £149,000 on five settings, but will pay £228,000 from April 2017.

For example, business rates on the group’s Knutsford nursery, a 188-place setting, are going up by 28 per cent; in Macclesfield, a 174-place nursery, the rates are going up by 71 per cent. Both are in the Cheshire East local authority area.

‘We’re now having to re-do our budget,’ Ms Johnson said. ‘The Government needs to stipulate to local authorities that nurseries do not have to pay business rates.

‘The sector is already grappling with the challenge of delivering the 30 hours, the reduction in hourly funding rates, the National Living Wage, pensions, the apprenticeship levy, and this feels like a kick in the teeth for a sector that is already struggling on a shoestring.’

Andy Hayes, director of Bell House Nursery, registered for 96 places in Godalming, Surrey, has written to the early years minister Caroline Dinenage with his concerns.

He told Nursery World, ‘I was annoyed, a bit shocked really. To go up from £43,000 to £78,000 [rateable value]. I feel we’re being squeezed all the time. It will end up being passed on to parents.’

When he started operating in July 2012, the rateable value was set at £54,000, but he appealed and this was reduced by £11,000.

The Government sets a multiplier, which represents the number of pence in the pound by which the rateable value is multiplied to calculate business rates payable for the year.

For 2016/17 this will be 49.7p in the pound.

Business rates for Bell House Nursery will rise to around £38,000.

In his letter to the minister, Mr Hayes wrote, ‘I thought it was the Government’s intention to make daycare more affordable for parents! We are not the only daycare nursery in Godalming to be subject to an increase in business rates. These additional overheads will undoubtedly have to be passed on to the parents, many of whom are already struggling to pay.’

Keith Appleyard, treasurer of Fiveways Play Centre in Brighton, said the rateable value of his nursery will go up by 56 per cent, from £37,500 to £58,500.

‘That means we will be paying an increase of over £200 a month, thus adding another 2-3p an hour to our break-even rate, just as we’re already making an 87p an hour loss on the funded hours.’

He added, ‘The only consolation is that as we are a charity, we are still entitled to 80 per cent Mandatory Business Rates Relief. But consider the impact on our local for-profit competitors who are receiving a similar 56 per cent increase – say on a rates bill of £18,000 a year, that’s a £10,000 increase.’

EXEMPTION FIGHT

NDNA has long campaigned for nurseries to receive full exemption from business rates.

Chief executive Purnima Tanuku said, ‘These rises will be a huge burden for nurseries which are already facing severe financial pressure from increasing payroll costs associated with the National Living Wage and uncertainties around the forthcoming 30 funded hours.

‘According to NDNA’s annual nursery survey, nurseries’ average business rates bill in England this year was £13,689. Increases will leave the majority of nurseries having to find thousands of pounds more to cover new levels at a time when money is tighter than ever for them.

‘Following our lobbying, the Department for Education wrote to councils in January last year recommending this, but to our knowledge no local authority has acted upon this advice.’

A Government spokesperson said, ‘We are also working to allocate money more fairly around the country and introducing a requirement for local authorities to pass on 95 per cent of funding to the front line, as well as removing the barriers facing businesses, including some nurseries, by reducing their costs through our reforms to business rates.’

The Government said that for those businesses facing a rates increase as part of the reforms, there would be a £3.4 billion fund for transitional support.

Ken Williams, senior surveyor at property consultancy Lambert Smith Hampton, said, ‘Any increases in rateable value above about 15 per cent will be protected by a phasing of the increase over a number of years.

‘As an example, if the current rateable value is £30,000 and the new value is £45,000 then transitional relief will reduce the rates bill for the first two years and the full effects of the increase will not apply until the 2019/2020 rate year.’

He added, ‘A limited transitional relief scheme will also apply in Wales, for premises that are currently eligible for small business rates relief. No announcement has yet been made about transitional arrangements that will apply in Scotland.’

Case studies: business rates changes at four nurseries

How the rates are calculated

The Valuation Office Agency has launched an online tool that shows draft rateable values. From this business owners can see an estimate of what their rates will be.

Business rates are a tax payable on non-domestic property and are calculated on the value of a commercial building. Single-site businesses with a rateable value (annual market rental value) of £12,000 or less will be exempt from any charge from April 2017.

Property consultancy Lambert Smith Hampton partners with the NDNA to offer members advice on business rates.

Senior surveyor Ken Williams has checked 32 sample nursery properties against figures from the online tool. He found typical rises of 45 per cent or more in relatively well-off areas of Liverpool, Leeds and Manchester; 30 per cent rises in the Midlands; and average increases of around 10 per cent in the South West.

Some businesses were set to see increases of as much as 115 per cent along the M62 corridor and the South East.

Meanwhile, rises for businesses in Cumbria and Wales were only 5 per cent.

- Access the consultation into transitional Business Rates here